- Author: Windsor Life Settlements

- Published Date:

Chapter 5: What Have the Returns Been for the Last 10 Years?

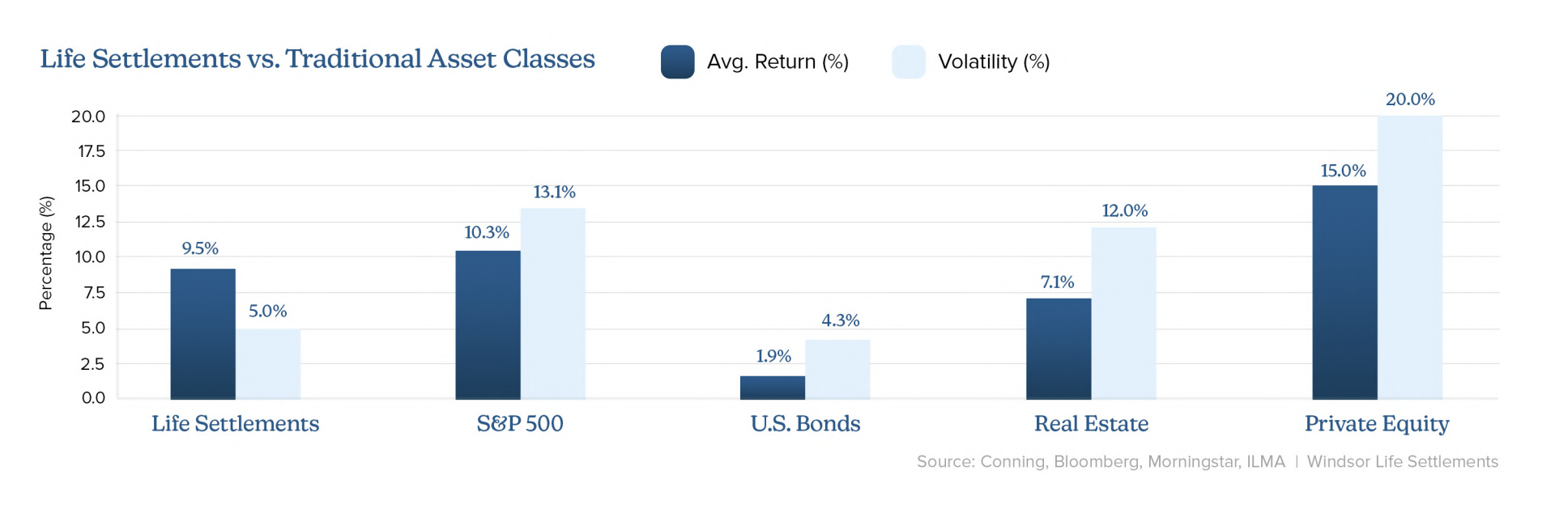

Life settlements have become one of the most compelling non-correlated investments in the alternative asset space, often producing bond-like stability with equity-like returns. While this asset class is still relatively underutilized, its performance over the past decade has rivaled — and in some cases exceeded — that of stocks, bonds, and real estate, particularly when measured on a risk-adjusted basis.

In this chapter, we’ll look at:

- Historical returns from life settlement funds

- IRR ranges and volatility profiles

- How these returns stack up against traditional investments

- Real-world case studies of fund performance

- What the future may hold for this maturing asset class

Historical Performance of Life Settlements

Over the last 10 years, life settlements have delivered net annualized returns in the range of 8–12%, depending on the structure, diversification, and duration of the portfolio. Unlike equities or real estate, which are prone to cyclical swings, life settlement returns are derived from actuarial timelines and backed by contractual payouts from highly rated insurance carriers.

Risk Profile:

Life settlement portfolios typically exhibit low standard deviation (4–6%) and Sharpe ratios >1.0, outperforming many hedge fund strategies and fixed-income instruments on a risk-adjusted basis.

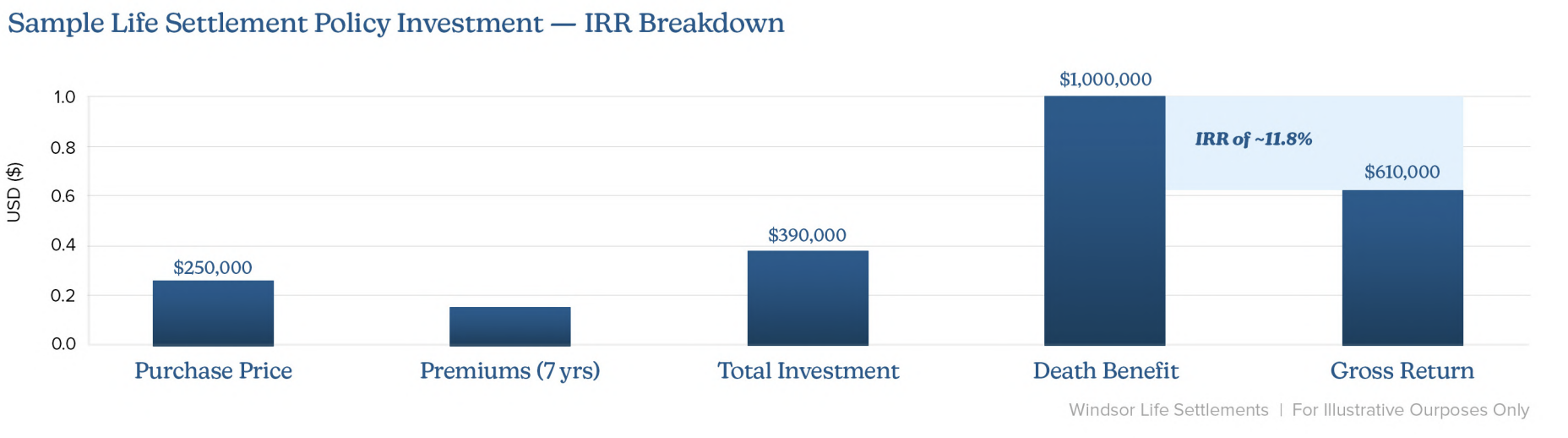

IRR Potential and Return Structure

The internal rate of return (IRR) for an individual policy is based on:

- Purchase price relative to death benefit

- Premium payment obligations

- Estimated life expectancy (LE) of the insured

- Time horizon until maturity (payout)

For example, purchasing a $1 million universal life policy for $250,000 with $20,000 annual premiums and a 7-year life expectancy could yield an IRR of approximately 12%, assuming the insured passes on schedule. A later-than-expected maturity may reduce that IRR to 8–9%, while an earlier event could boost returns to 15%+.

Important Note: Life settlements do not compound like traditional interest-bearing assets. Returns are realized when the policy matures. That’s why diversification and staggered timelines are essential to building predictable, portfolio-level performance.

Comparison to Traditional Asset Classes

Here’s how life settlements have compared to other major asset classes over the past decade:

Source: Bloomberg, Conning, Morningstar, PitchBook (2024), ILMA reports

Note: Private equity and real estate often report gross IRRs, excluding fees or carry

While private equity may post higher returns, it typically comes with greater illiquidity, longer lockups, and higher volatility. Life settlements strike a balance — offering superior risk-adjusted returns and consistent performance across market cycles.

A side-by-side comparison of average return vs. volatility across major asset classes, showcasing how life settlements deliver competitive returns with low volatility.

Real-World Fund Performance: Case Snapshots

Case Study 1: Large Institutional Fund (2014–2023)

- Portfolio: 650 policies, $1.2B face value

- Avg. LE: 7.4 years

- Net Annualized Return: 9.1%

- Volatility: 4.3%

- Drawdowns: None in any calendar year

Case Study 2: Boutique Fund Focused on Short-Term LEs (2016–2022)

- Portfolio: 120 policies, $150M face value

- Avg. LE: 4.1 years

- Net Annualized Return: 11.3%

- Strategy: Higher turnover, short-duration policies

- Risk: Slightly higher servicing costs, increased mortality variance

These case studies demonstrate that life settlement fund strategies can be tailored — some aim for steady cash flows, others for IRR maximization. But in both cases, capital preservation and return visibility remain high.

A sample IRR breakdown of a life settlement policy investment, showing how purchase price, premiums, and final death benefit translate to a projected IRR of ~11.8%.

Future Outlook for Returns

Despite rising demand, life settlements are expected to maintain competitive return levels for several key reasons:

- Policy supply continues to grow: Over $3 trillion in life insurance is held by seniors aged 65+, much of it underutilized or unaffordable in retirement.

- Demographics support expansion: 10,000+ Americans turn 65 every day through 2035 (U.S. Census Bureau).

- Interest rate compression favors alternatives: If the Federal Reserve reduces rates to stimulate growth in response to trade disruption, demand for fixed-yield alternatives like life settlements will likely rise.

- Technology and underwriting advancements: Improved LE models and servicing infrastructure reduce risk and increase transparency for institutional investors

Conclusion: A Compelling Return Profile — Without Market Exposure

Life settlements may lack the glamour of IPOs or the momentum of growth stocks, but they offer something increasingly rare: predictable, actuarially-modeled returns that aren’t tied to economic noise. With 8–12% target IRRs, low correlation, and strong performance through downturns, they are earning a place in the portfolios of family offices, pension funds, and yield-seeking accredited investors alike.

Over the past decade, life settlements have proven to offer equity-like returns with bond-like stability — outperforming many traditional alternatives when adjusted for risk and volatility. As future market conditions evolve, this steady, actuarial-driven asset class will only grow more valuable.

Windsor Life Settlements gives investors direct access to curated policies and institutional-quality portfolios, ensuring alignment with return expectations, liquidity needs, and risk tolerance.

In the next chapter, we’ll explore the advantages of working with a life settlement broker or provider, and how Windsor helps investors access high-quality opportunities with due diligence and security.

- Author: Windsor Life Settlements

- Published Date:

Windsor Life Settlements

Questions? Comments?

We’re available by phone Monday-Friday 9am-5pm CT