Article Summary:

“If you’re an estate planner, family law attorney, or a policyholder considering a life settlement as a financial strategy , this article is worth a quick read. This is a collection of market data, industry statistics, and case examples that highlight a life settlement’s potential. It should help assure you that this often misunderstood financial option can help your clients manage financial matters related to estates, divorces, and long-term planning.” – Ken Kelly, CEO.

The Market Continues To Grow, Despite Challenges, likely here to stay.

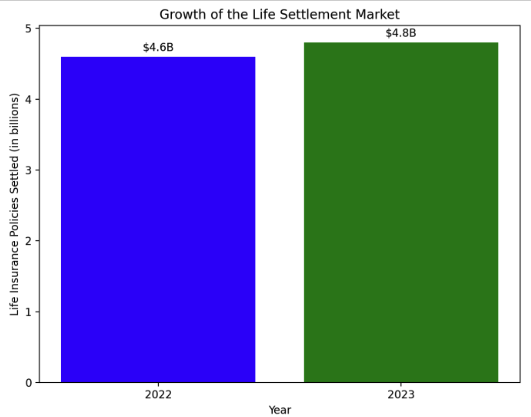

According to Conning’s 2023 “Life Settlements Market Review,” the life settlement industry saw significant growth in recent years, with a continued increase in transaction volume. The report projected $4.8 billion in life insurance policies would be settled in 2023, up from $4.6 billion in 2022. This reflects increasing awareness, demand, and consumer confidence in life settlements, especially among seniors and policyholders with significant health impairments.

Most life settlements involve seniors aged 65 or older, with the largest volume of settlements among individuals over 75. The growing number of aging baby boomers—over 54 million Americans aged 65 and older as of 2023, according to U.S. Census data—has created a larger market for life settlements. Many of these seniors no longer need their life insurance policies and may face financial challenges, making life settlements a viable solution.

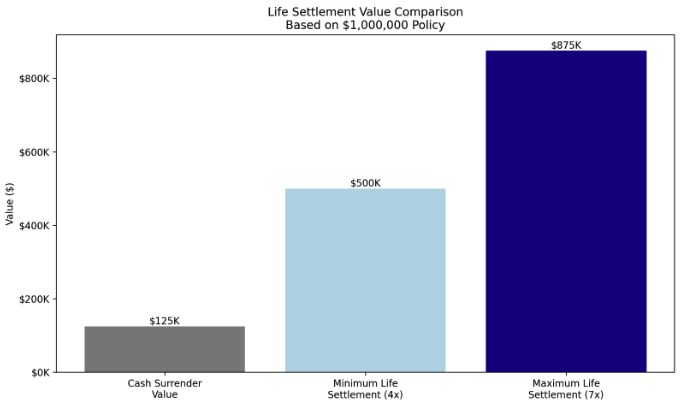

Life settlement payouts can provide significantly more than the cash surrender value (CSV). According to the Life Insurance Settlement Association (LISA), the average life settlement offers approximately four to seven times more than the cash surrender value a policyholder would receive from an insurer. This makes life settlements an appealing alternative to simply letting a policy lapse or surrendering it.

A policyholder with a $1 million universal life policy might receive $40,000 in cash surrender value from the insurer. In contrast, a life settlement could yield $150,000 to $300,000 or more, depending on the age, health, and terms of the policy. These higher returns provide estate planners with a powerful tool to offer clients, especially when liquidity is needed.

In a high-net-worth divorce case, a couple held a joint life insurance policy worth $3 million. The policy was originally intended to protect the family’s income in case of death, but after the divorce, the policy no longer served its intended purpose. Rather than continue to pay expensive premiums, the couple worked with their attorney to sell the policy via a life settlement. They received $500,000 in proceeds, which was split between them as part of the division of marital assets. This offered a cleaner, more equitable asset division than keeping the policy intact.

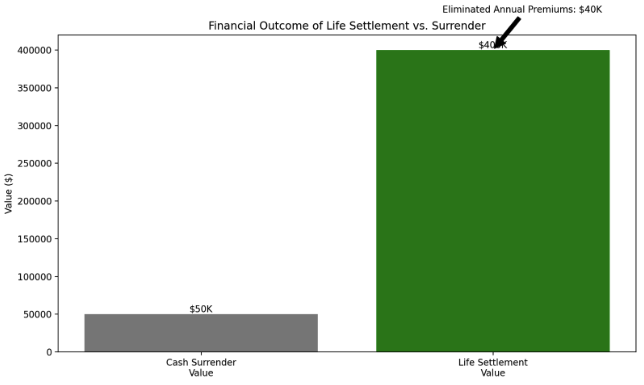

A 72-year-old woman had a $2 million life insurance policy that was no longer needed after her children became financially independent. The annual premiums of $40,000 were becoming burdensome. Rather than surrender the policy for $50,000, she opted for a life settlement and received $400,000. This allowed her to eliminate premium payments and invest the cash in an annuity that provided her with an income stream for her remaining years.

Many seniors find that premium costs for their life insurance policies increase substantially as they age. Permanent life insurance policies, like universal life, often experience premium increases due to cost-of-insurance charges rising over time. According to industry estimates, many policyholders are unable to afford these premiums in their later years, leading to an increase in policy lapses.

The U.S. Department of Health and Human Services estimates that 70% of Americans aged 65 and older will require long-term care at some point in their lives. Long-term care can be a significant financial burden, with the average cost of a semi-private room in a nursing home being $94,900 per year in 2023. Life settlements can help seniors access funds for long-term care, providing them with liquidity without depleting their savings.

Firstly, Windsor is not a tax expert.

However, in our experience, life settlement proceeds are typically subject to income tax, but tax liabilities can be reduced or managed with strategic planning. For example, the cost basis of the policy (premiums paid) is subtracted from the payout before taxes are applied. The proceeds are usually taxed at three levels:

Estate Tax Planning: For wealthy clients whose estates exceed the federal estate tax exemption (currently $12.92 million per individual in 2023), life settlements can help reduce the taxable estate by converting policies into liquid cash, which can be allocated or gifted under specific tax-exempt limits.

Life insurance policies often form part of divorce agreements, especially when securing child or spousal support payments. Family law attorneys can use life settlements to convert policies into cash that can meet these obligations. According to the American Academy of Matrimonial Lawyers (AAML), life insurance is frequently a critical element in high-net-worth divorces, and using a life settlement can make asset division more equitable.

In situations where the spouse paying alimony is struggling with high life insurance premiums, a life settlement offers a solution that can preserve cash flow while ensuring financial security for the receiving spouse. The proceeds from a settlement can be placed in a trust to ensure future payments, alleviating the burden on the policyholder.

Many states have passed legislation to protect consumers in life settlement transactions. As of 2023, 43 states have regulations governing life settlements, ensuring that clients receive fair market value and that brokers and providers follow transparent practices.

A survey conducted by the Life Insurance Settlement Association (LISA) found that 55% of seniors aged 65 and older were unaware of the life settlement option. However, as awareness has grown, life settlement transactions have increased. More financial advisors, estate planners, and attorneys are now recognizing the potential benefits of these transactions for their clients.

© 2025 Windsor Life Settlements, LLC. All rights reserved.