Life insurance is divided into two types. Permanent policies and term policies. While shopping for life insurance you’ll find there are actually two types of permanent policies. Both whole life insurance and universal life insurance.

Permanent policies provide coverage for your whole life. While term life insurance policies provide coverage for a set time period. Permanent policies accumulate cash value as you pay your premiums while term life insurance policies don’t.

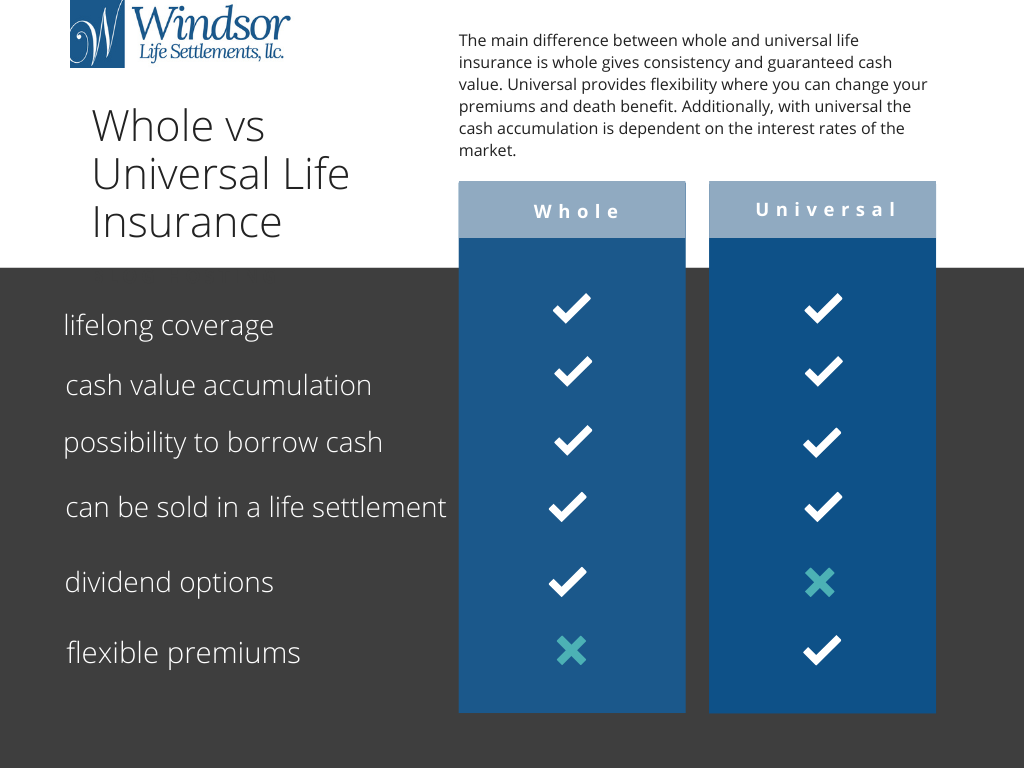

Before we get into whole vs universal life insurance, let’s look at how these permanent policies are the same.

Permanent life insurance policies have two parts: an investment side and an insurance side. The premiums you pay are divided up into these two parts. For this reason, the premiums are higher for permanent policies than for term policies.

Permanent policies accumulate cash value as you pay your premiums. After you’ve had your policy for years, you may be able to borrow money from the cash value. When you’re 70 years old, you can qualify to sell your permanent policy in a life settlement.

Permanent policies are an asset. You can use the benefits while you’re living rather than as a death benefit. There are a number of riders used to customize permanent policies to tap into these benefits.

Whole life insurance provides consistency while universal life insurance provides flexibility. These policies usually have fixed premiums and a guaranteed accumulation of cash value. This is the only policy that provides yearly dividends (returns on your premiums).

This policy covers you for the rest of your life. As long as you continue paying your premiums, you have a death benefit for your beneficiary. With whole life insurance, you get this peace of mind as well as a savings portion. A portion of your premiums is invested by the insurance company. Each time you pay a premium, more money is invested. This is how cash value is accumulated.

If you want to take a loan from the policy, you can only take from the cash value and not the face value. This way, your death benefit remains the same.

With whole life insurance policies, you can borrow against the cash value or sell your policy to pay for retirement or a medical emergency.

Universal life insurance grants flexibility in premium payments and the death benefit. As well as the investment portion of the policy. All of these may change while you have the policy. For this reason, universal life insurance is sometimes called adjustable life insurance.

You have the power to change your death benefit. As well as pay your premiums at different times and amounts as long as you have money in the account. You may need a medical exam when changing your death benefit, but it allows you flexibility if your circumstances change. For example, if you have additional dependents you may want a higher death benefit.

You can also use the cash value to pay the premiums if you have accumulated enough money in that part of the account.

The flexibility of universal life insurance is certainly a pro, but universal policies also have a con. The money accumulated in universal policies is dependent on the interest rate which depends on the current market conditions.

There’s no guaranteed cash value accumulation. You may accumulate lots of cash or you may not gain as much as you had anticipated when you bought the policy. The flexibility of universal life insurance comes with risk.

Which type of policy is best for you will depend on the needs of your dependents as well as how comfortable you are with risk.

If you have a dependent that will require long term care, a permanent policy is what you’ll need instead of a term life insurance policy. A whole life insurance policy may be best in this situation as your death benefit and cash value is more consistent.

If you aren’t sure what coverage you will need in the future and you are okay with taking a risk with interest rates, then a universal policy is a good fit for you.

Both types of permanent life insurance policies are expensive. Getting coverage when you’re young will be easier and more affordable. The average premium for a male rises 258% between ages 25 and 50.

Both types of policies give you an asset you can pull from in the future as your circumstances change. Additionally, they can eventually be sold in a life settlement if you decide you no longer need the policy after all.

Get an instant quote for a policy.

© 2025 Windsor Life Settlements, LLC. All rights reserved.