If you’ve been asking yourself, “are there companies that will buy life insurance policies?” the answer is yes — and there are several reputable ones. These life settlement companies help policyholders turn an unwanted or unneeded life insurance policy into a meaningful cash payout, often far exceeding the surrender value.

The question isn’t if there are buyers of life insurance policies — it’s which type of buyer is right for you. Some operate as direct buyers, purchasing policies for their own portfolios. Others, like brokers, represent the policyholder’s interests and invite multiple bids from institutional buyers. Both models have advantages.

Below, we highlight the top five companies in the space — giving each the respect they’ve earned — while making clear why Windsor holds the top spot, though we may be a bit biased.

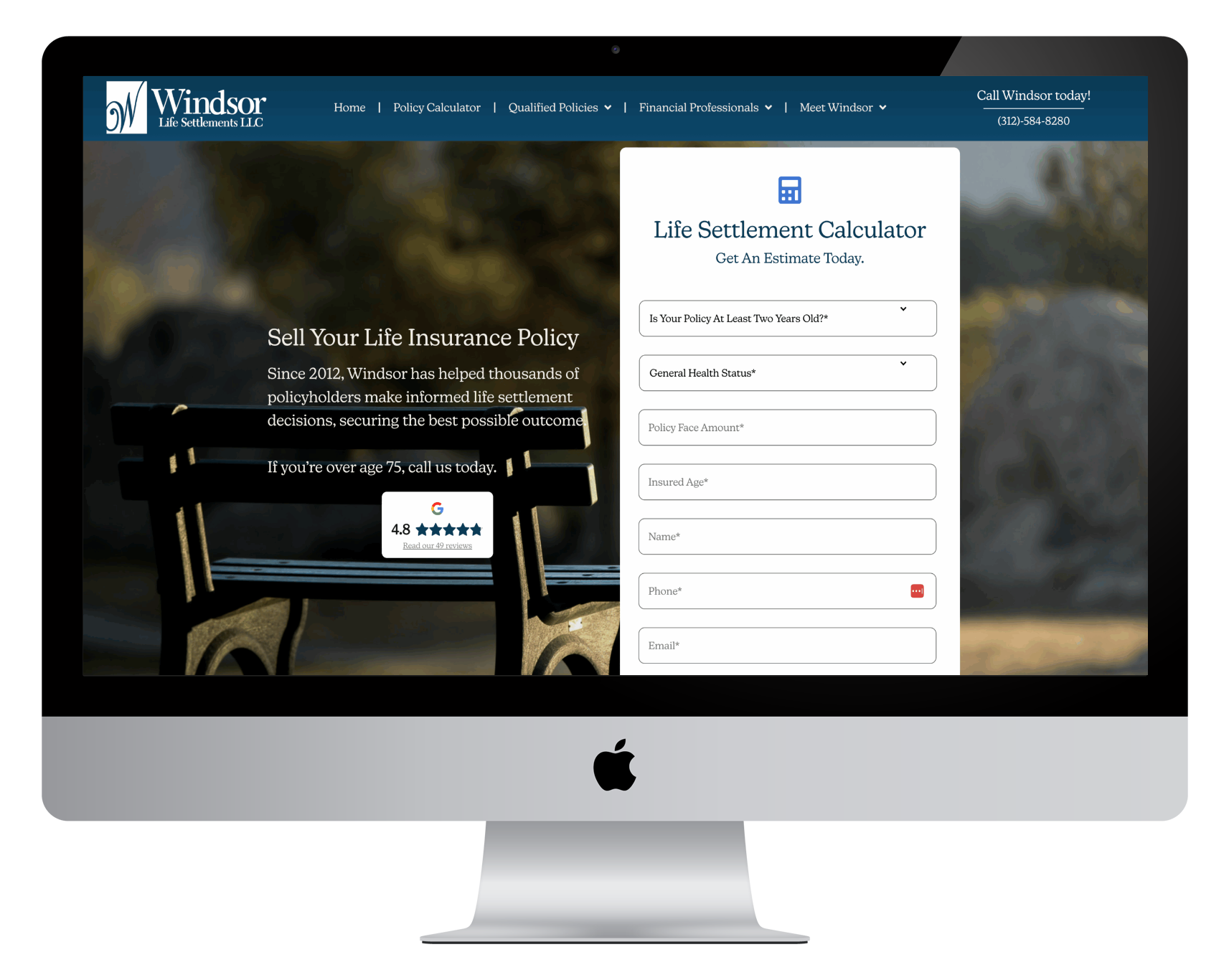

1. Windsor Life Settlements — The Fiduciary Approach That Delivers the Highest Offers

Website: windsorlifesettlements.com

Windsor is not the largest name in the industry — and that’s precisely the point. As a fiduciary life settlement broker, Windsor’s loyalty lies with the policyholder, not a single buyer. This legal obligation to put clients’ interests first means we run a competitive bidding process, bringing multiple institutional buyers to the table.

The result? Offers that are often substantially higher than what a direct buyer, no matter how reputable, can provide on their own. Windsor’s process is especially valuable for high-value, complex, or impaired-risk cases. Even after commissions and fees, policyholders consistency see the highest offers working with a broker. For this reason, we rank ourselves number one.

Pros:

- Fiduciary responsibility

- Expert navigation of a complex process.

- Deep experience and long-standing industry relationships

Cons:

The bidding process can take longer than accepting a single offer from a direct-buyer

2. Beca Life Settlements- A Viatical & Life Settlement Company

Website: becalife.com

Should you decide to reach out to Beca Life Settlements, you’ll appreciate how they offer no-pressure guidance from start to finish. There’s no pressure tactics insisting that you “accept an offer before it gets pulled” tactics that some companies employ. They provide accurate and transparent information to help you make an informed decision. Even if a policyholder decides not to sell, that decision is always met with respect and understanding. Their mission is to find success by educating policyholders, not pressuring them into accepting offers. Genuinely good people work at Beca Life and we are proud to include them on our list.

Pros:

- Fiduciary responsibility

- Expert navigation of a complex process.

- Deep experience and long-standing industry relationships

- Willing to consider smaller policies than many competitors.

Cons:

- The bidding process can take longer than accepting a single offer from a direct-buyer

3.) Abacus Life Settlements – A Direct Buyer of Life Insurance

Website: abacuslifesettlements.com

Abacus has purchased life insurance policies from consumers since 2004. With over $5BN in face value of policies purchased, they have helped thousands of clients maximize the value of life insurance. Abacus Life is the only publicly traded life settlement company, listed on the Nasdaq Exchange under the ticker symbol ABL.

They boast impressive numbers. Over the past 21 years, they’ve become institutionalized in this space. Supported by a 150+ person team, long-term relationships with 78 institutional partners, 30,000 financial advisors, and the ability to operate in 49 states. Abacus has serviced approximately $950 million in policies and has managed assets for large asset managers and third-party investment funds. Abacus has underwritten and valued approximately $520 million of policies on behalf of third parties.

Pros:

- The only publicly traded life settlement company.

- HIPAA certified and fully licensed on a national scale.

- 24-hour ‘approximate’ quotes

- Fast closing times

Cons:

- Direct buyer model means a single offer, usually on the lower end.

- They will represent shareholder interests, not yours.

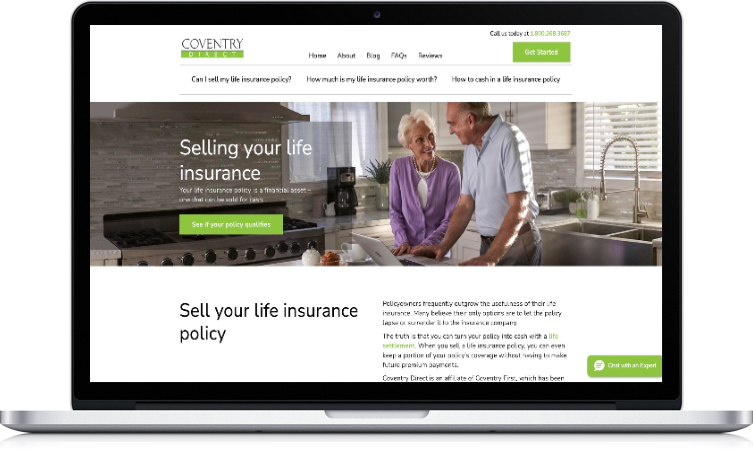

4.) Coventry Direct – A Direct Buyer of Life Insurance

4.) Coventry Direct – A Direct Buyer of Life Insurance

Website: coventrydirect.com

Coventry Direct is part of the Coventry Group, a pioneer and longstanding leader in the life settlement industry. The group has:

- Over 40 years of experience, credited with expanding the life settlement market since 1982.

- Delivered over $6 billion directly to consumers through life settlements, and structured $45 billion in longevity transactions overall

Read a more detailed review of Coventry Direct